NEW DELHI: The Centre has set up a Finance Minister Nirmala Sitharaman-led Covid-19 economic response task force, which would assess the requirements of various sectors and also oversee implementation of the proposed measures.

The decision comes in the wake of severe impact of Covid-19 on several sectors, including aviation, hospitality and tourism along with the overall economy.

The task force may look at measures, such as extension of loan tenors for the micro, small and medium enterprises (MSMEs) and relaxing NPA (non-performing assets) norms, while on the taxation part, GST may be waived on hospitality and tourism sectors.

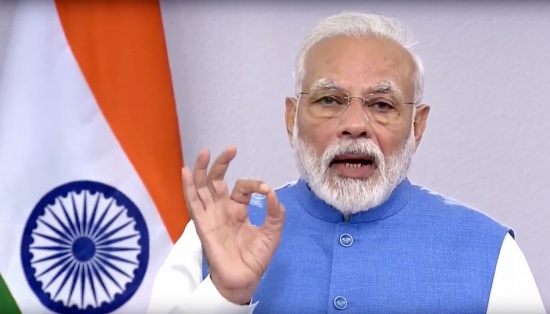

Addressing the nation on Thursday, Prime Minister Narendra Modi also promised adequate availability of essential items and services, including medicines, healthcare, milk and food. He urged the citizens against panic and hoarding of essential items.

The task force will consult stakeholders and garner feedback, on the basis of which decisions will be taken to meet the economic challenges posed by Covid-19. It will also ensure implementation of decisions taken to meet these challenges.

The Prime Minister urged the business community and the rich to look after the economic needs of people from the lower income groups, from whom they receive various services. He urged them not to cut their salaries for days they couldn’t render the services due to inability to come to the workplace.

Airline companies, too, might get relief from airport charges.

The Finance Minister will meet the animal husbandry, dairy, fisheries, civil aviation, MSMEs and tourism Ministers on Friday to assess the economic impact of COVID-19. The meeting will also be attended by officials from the finance and other ministries.

The inputs could be used by the task force for devising sector-specific strategies to deal with Covid-19’s economic fallout.

Welcoming the move, Abheek Barua, Chief Economist, HDFC Bank, said the task force might have to look at further relaxing country’s fiscal deficit to provide funds to the affected sectors. The task force faced daunting challenges, he added.

Meanwhile, ratings agency Crisil recently cut the gross domestic product (GDP) growth forecast for FY21 to 5.2 per cent from 5.7 per cent due to coronavirus. “In any case, India has little policy firepower to give a meaningful push to growth, and the pandemic is making it more difficult,” Crisil said in a report.

While there would be steeper deceleration in global growth and India’s trade, the extent of impact on economy through domestic channels of production (supply) and consumption (demand) was not clear, it said.

Many companies in the aviation, tourism, export-oriented sectors, particularly taxtile manufacturers and even the multiplex and retail sectors, have been affected by Covid-19 outbreak.

Companies, like IndiGo and GoAir, have announced pay cuts and leave without pay for employees. Industry watchers say if the spread of Covid-19 infection rate continues, the companies will be forced to downsize.

Meanwhile, the country’s key stock markets have witenssed massive bouts of volatility eroding lakhs of crores of investors wealth.

According to Nilesh Shah, MD at Kotak AMC, if India faces a similar impact as China, the domestic GDP growth may fall by around two per cent.

Various industry bodies have suggested that the Centre should come out with a combination of fiscal and monetary policy, including lending rate cut and amending NPA laws.

One of the key demands of the industry has been to delay declaring companies’ accounts as NPA for one year.

To provide relief to companies, markets regulator SEBI recently relaxed compliance norms for listed companies and allowed them to file fourth quarter and annual financial results by June 30.

Similarly, the Reserve Bank of India decided to conduct more long-term repo operations and the dollar-rupee swap.

Till now the government has allowed the provision of “Force Majeure”, which absolves companies from liabilities arising out of natural calamities. IANS