- Articles are shared in google folder- these are the credits which should be there – there are

Amit Inamdar, President, MBA, Broker

Own Sweet Home Realty

www.OwnSweetHome.net

Review of Tri-Cities & Tri-Valley areas

Amit Inamdar

A Standard question gets asked whether I am at a social event or at the open house, hey Amit, how is the market? We hear about all kinds of talk going in the market place. Multiple offers, overbidding, buyers tired of writing offers after offers and confusing loan programs. We have seen a long stretch of the housing market rise since 2010 and we are expecting further upside in the market place. IF you listen to my weekly radio show “Power Hour with Amit Inamdar” every Friday at 4 pm on 1550 AM, you may understand the reasons behind this further increase in home prices.

As I indicated in my radio show on Friday January 6, this market has become very selective. Some areas are high in demand and in other areas homes are staying on the market longer. Something we did not see for quite a few years, are the expired listings, the listings that did not sell after being on the market, are showing up. So answer to the question, how is the market depends upon who do you talk to and the local real estate markets.

Before we go into specific markets, remember that the markets are driven by low inventory of homes. The high demand for homes is relative to the low inventory, however, driving force is the low inventory of homes.

As I have always indicated, for a buyer, monthly payments are more important than the price of the home. The monthly payments depend on the loan amount and the mortgage interest rates. In low rate environment we have for past many years, slight increase in the rate increase the interest payment proportionately. E.g. as the rates have climbed from 3.5% on 30 year fixed to 4.25% range, that is over 20% jump in the interest rates and reflects proportionate 20% rise in the interest payment on your loan. Also, that does not mean the home prices may drop by 20% to balance off the rise. So buy today. You can always refinance if the rates drop.

This article focuses on the tri-cities and tri-valley markets. Tri-Cities market includes cities of Fremont, Union City and Newark. I like to call them FUN cities. Tri-valley markets include Pleasanton, Dublin and Livermore. Following graphs show the median sales price for detached homes and inventory of homes that are available for sale (active), in contract (pending) and sold is also shown in the adjoining graphs. (Courtesy of Bay East Association of Realtors)

Fremont Real Estate

One may think the Fremont market has gone down based on the graph above. However, certain areas of Fremont are commanding multiple offers and market is rising. Currently the hot area is the 94538 zip code, that has climbed from mid $600K to over $900K in past few years. Median price means half the homes above and half the homes below the median price. More sales are happening in the lower price range and that is why you see lower median price.

Union City Real Estate

Union City Real Estate

In addition to the comments I made for Fremont, in Tri-cities, you see the inventory driving the sales. Low inventory mean low number of active homes, low number of pending homes and sold properties. With seasonal inventory growth, we should see more inventory come in the market, however, so will be the number of buyers. What I have seen over past 4-5 years is that the market peaks around May-June time frame and buyers go on the sidelines. Buyers who have lost in the market place, bid after bid and have seen market jump up 50-100K in 6 month period, decide not to buy. Market slows until October time frame and starts to pick up again. Those who get in early, experience the home price rise give a good feel about buying a home. It’s always better to buy in the rising market, meaning the seller’s market to see immediate rise. Conversely, if you buy in the buyer’s market, meaning buyers are negotiating prices down, you may see values drop after you purchase the home. However, if you have a loan with affordable payments, there is not much to worry about.

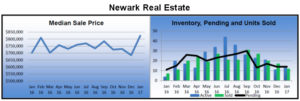

Newark Real Estate

Newark Real Estate

As the Fremont and Union City continue to climb, you now see the Newark market picking up. Even the home builders have started building in Newark and the prices are upwards of $800K for the single family homes. The FUN cities do represent a central location for commute to the job centers around the bay area whether you are driving or taking a BART.

Now let’s go across the 680 corridor. The Tri-Valley area. Here we have cities of Pleasanton, Dublin and Livermore.

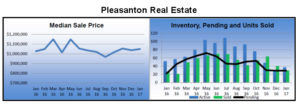

Pleasanton Real Estate

Pleasanton Real Estate

I like Pleasanton. This is a steady market. Even in the downturn of 2008, the Pleasanton market stood strong compared to other neighborhood cities. All schools are good. They have been decent all along and no one really complained about the Pleasanton schools.

Clients always ask me in the initial meeting, Amit, how much should one overbid? And I show them the real time data. If you run numbers for the list price vs sale price, they are all over. Some homes sell well above asking while others little above asking and some even below asking. All depends on where the seller prices the home based on the advice sellers receive. However, buyers in open market will bid to provide the market value for the home. Only close to real time analysis of the market inventory can determine the right price in light of the *resent competition. It requires being in the market and taking advice of a real estate consultant, like me, to get into the home of your dreams.

Visit OwnSweetHome.Net for higher level of services offered for the bay area real estate buyers, and sellers. We also provide mortgages that fit your down payment and affordability needs. First Time Home Buyer Webinar and Secrets to Getting Top Dollars for Your Home for the Home Sellers are great resources.

Remember, those who short sold their homes in the aftermath of 2008? Well, that was a wrong thing to do in retrospect. I personally advised against such moves at that time. Those who did so anyway, even though they had means to pay the monthly mortgage comfortably, got hurt. They were barred from getting loans anywhere from 4-7 years and the prices were same as what they had bought the home for originally, when they became eligible to buy. Some even had to pay higher interest rates due to lowered credit scores. With limited work life to age 65, it’s hard to play the game of short sale. Would you not rather have a free and clear paid off property by the time you retire?

Dublin Real Estate

Dublin Real Estate

Who does not like newer construction? Dublin real estate has climbed due to the newer construction that took place since 2000. Many moved to Dublin as the homes were affordable and newer. Initial fears of the prison in the neighborhood waned as the shine of the homes took over. Now there is enough critical mass for this market to sustain going forward. However, remember, that the new communities are typically build in undesirable locations (near freeway, rail roads, or near industrial parks) and are the most affected in a downturn. Think – Location. Location. Location.

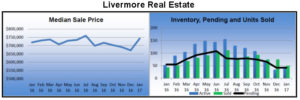

Livermore Real Estate

Livermore Real Estate

This area is still affordable to many. I have had clients buy home in Livermore when prices were in low 500’s and have gained substantially percentagewise. However, if you want to see the hot markets, surprise! Surprise!! Take a look at the FUN cities!!

January 2017 Data

| City | Median Price | # Active | # Sold | Sales/List Price |

| Fremont | 942444 | 79 | 58 | 101.00% |

| Union City | 780000 | 21 | 17 | 102.29% |

| Newark | 824300 | 14 | 12 | 100.12% |

| Pleasanton | 1050000 | 37 | 29 | 99.92% |

| Dublin | 1170000 | 33 | 18 | 98.77% |

| Livermore | 743000 | 46 | 50 | 99.32% |

Amit Inamdar, Realtor – is a Real Estate and Mortgage Broker and is serving the communities of the Bay Area since 2000. He runs a popular radio show “Power Hour with Amit Inamdar” that airs on 1550 AM every Friday at 4 pm. Visit his website: OwnSweetHome.Net or call him at (510) 364-6686 CA BRE 01355522, NMLS 236574