AMIT INAMDAR

Whether you own home or rent a place to live, you are always paying towards a mortgage. How, you ask? If you own a home with a loan, you are paying mortgage on your own home. If you are renting, you are paying the payment of the landlord’s mortgage plus the rate of return the landlord is expecting on that mortgage. So what would you rather pay? Every household must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, home owners pay debt service to pay down their own principal and build equity to a level that, at the end of the mortgage term, they have paid down the home and are living mortgage free.

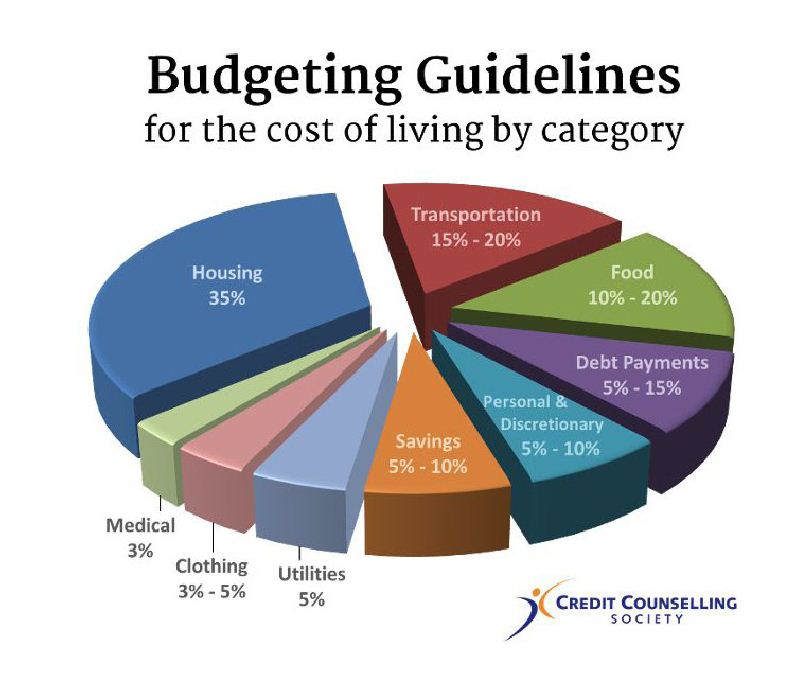

Have you ever looked at your monthly expense chart? The largest portion of your expenses is consumed by housing. And if you want to retire comfortably, housing expense is the one that must be eliminated. However, everyone needs a place to live; and to eliminate housing expense means owning your living space free and clear. Owning a home and paying off the mortgage will allow you to do that.

Have you noticed that the rents keep going up and up over a period of time? That can be attributed to inflation as well as the supply and demand for housing. Just at 3 per cent inflation, your rents will double every 24 years. So think, how old are you today? How much rent are you paying today? How old will you be 24 years from now and 48 years from now?

Rent of $3,000 today will be $6,000 in 24 years and $12,000 in 48 years – just at 3 per cent inflation.

Still not convinced? Let’s get math to the rescue. Rent after 24 years = 3000*(1+3%)**24 = $6098.

Also, think of rents 24 years ago. I came to the Bay Area in 1994 and an average one-bedroom apartment was $1,200 per month in the Silicon Valley. Today, it is over $2,400 in the same neighborhood.

Now, I am going to tell you a secret. What if I told you that your rents will not go up for the next 30 years? And in the process, you will accumulate enormous wealth. This is where owning a home comes into play. Let’s say you own a home with a monthly payment of $3,000, or even $5,000.

By paying only that much money using a 30-year fixed rate mortgage, your housing expense at the end of 30 years will be zero. So if you bought a million dollar home today with 20 per cent down payment, your monthly payments of $3,820 at 4 per cent interest will pay off the home in 30 years. Your housing payments will never go up and you will be a millionaire, even if the home prices do not go up.

What I am noticing is, historically, the Bay Area real estate prices have doubled every 10 years. That means housing is providing a 7 per cent rise year after year in these thriving markets. So, I have seen many of my clients who have owned homes, yes, I mean homes, plural, accumulate enormous wealth and with investment rental properties, they have built a sizable $6-8 million real estate portfolio in just the past 10-15 years. Others I have seen have rented their multi-million dollar homes in Sunnyvale and Santa Clara and moved to low cost areas like central California, Texas, or Arizona and are enjoying a sizable cashflow on their retirement.

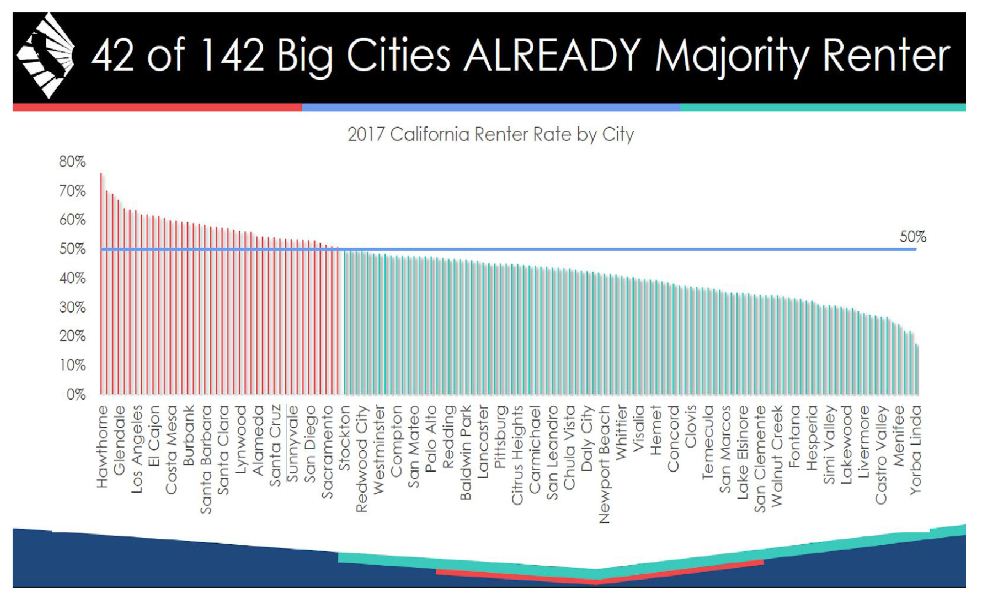

The following graphics by California Association of RealtorsⓇ, tells you the story. Over 50 per cent of the homes in cities of Santa Clara and Sunnyvale are rented and these landlords are enjoying $5,000+ per month of cash flow on their paid off home in their retirement while living in a low cost area, in a fully paid off home.

Such high returns are possible in the Bay Area, because, California’s economy is better than the G5 nation UK as of 2018, thanks to the high technology hub, talented people, and great weather. You are living in the most advanced valley in the world! Decision to own a home does not come easy. There are many considerations – personal as well as external. I have made it easy for you to understand the process of home buying.

All you have to do is visit my website: http://OwnSweetHome.net and watch the First Time Home Buyer webinar. This webinar is designed to answer all the questions a typical home buyer has and a lot more. What does it take to buy a home? When should you buy? Where should you buy? What should you buy?

My team at Own Sweet Home Realty helps you to achieve your home ownership dream. All our clients are exclusive members of my Happily Ever After Club and enjoy year-long participation in family activities and entertaining events.

I am offering a free initial consultation (lasts about 90 minutes) to anyone who watches my first time home buyer webinar by visiting my website. Just enter India Post in the comment section of the form.