BEIJING: China is facing “downward pressures”, Premier Li Keqiang admitted Friday as he announced plans to boost market vitality with a new foreign investment law backed by tax cuts to stabilise growth in the world’s second largest economy amid a bruising trade war with the US.

China is targeting a GDP growth range of 6 to 6.5 per cent this year, down from 6.6 per cent in 2018 – the slowest pace in 28 years.

“The Chinese economy is indeed encountering new downward pressure but we will not allow our economic growth slide below the reasonable range”, Li told journalists at his annual press conference held at the end of the nearly fortnight long meeting of China’s Parliament, the National People’s Congress (NPC).

To meet the 6 to 6.5 per cent target, China will not resort to a “liquidity deluge” method of quantitative easing to stimulate the economy because it will bring serious side-effects, he said.

Li said China will further cut taxes and fees, simplify administrative regulatory procedures, facilitate market entry and foster new growth engines and fair competition environment to boost market vitality.

China has announced that it will cut a total of two trillion yuan (USD 297.5 billion) in taxes and corporate pension payments this year to ease financial pressure on enterprises.

He also projected the new foreign investment law approved by the NPC in shortest possible time could be a main driver of growth in future.

China will introduce a series of regulations and documents in accordance with the foreign investment law to protect the legitimate rights and interests of foreign investors, he said skirting question that whether it was passed in a hurry to meet the US demands to a end trade war.

The US and China, the world’s two largest economies, are locked in a trade war since President Donald Trump imposed heavy tariffs on imported steel and aluminium items from China in March last year.

Trump imposed tariff hikes of up to 25 per cent on USD 250 billion of Chinese goods. In response, China, the world’s second largest economy after the US, imposed tit-for-tat tariffs on USD 110 billion of American goods.

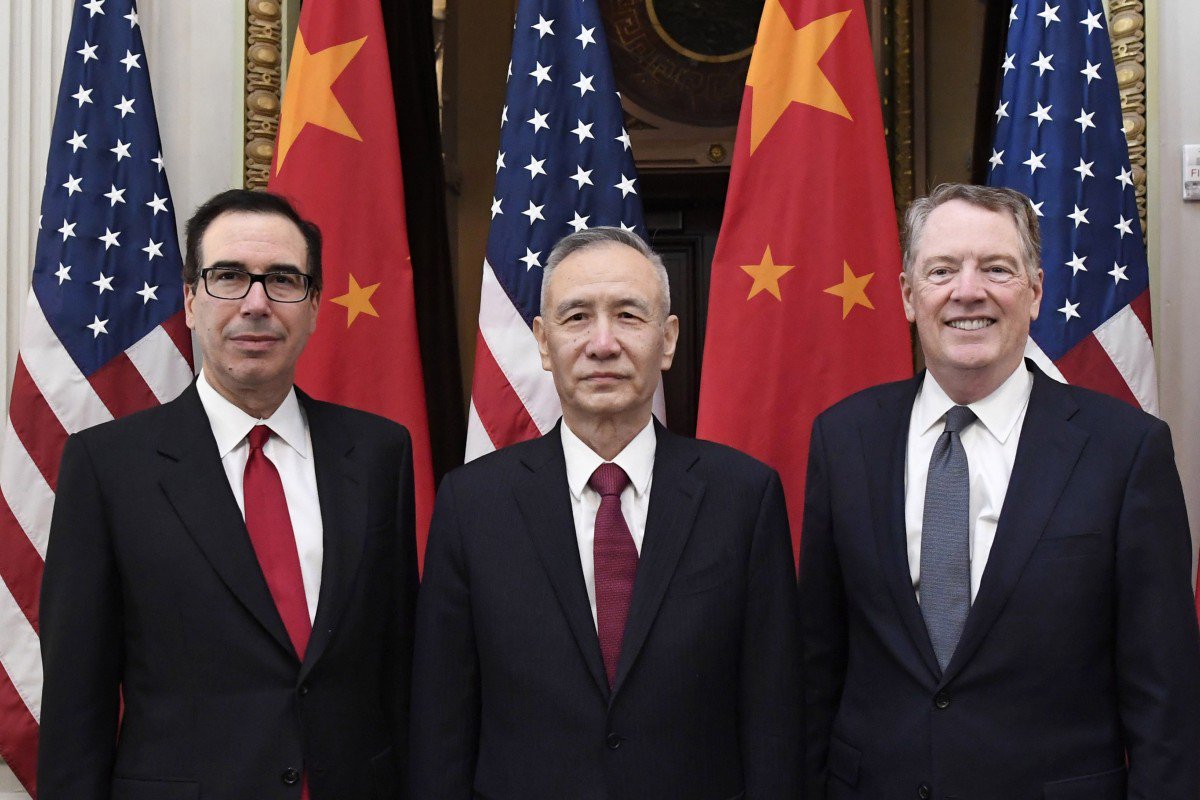

Top trade officials from America and China are holding talks to negotiate a comprehensive trade deal.

Trump is demanding China to reduce the USD 375 billion trade deficit, provide legal protection for intellectual property rights (IPR), technology transfer and more access to American goods to Chinese markets.

This is an important thing China has to do in the next step to ensure that the law is implemented smoothly, Li said.

He underscored efforts to make the complaint mechanism open, transparent and effective. The NPC on Friday passed the foreign investment law at the closing meeting of its annual session. The law will become effective on January 1, 2020.

The law will offer better legal support to the protection and attraction of foreign investment, as well as regulate government behaviours, Li said.

Li also said China can use such tools as the reserve requirement ratio of banks and interest rates to support the economy. But he stopped short of providing a timetable for any reserve requirement ratio or interest rate cuts.

Li said the downward adjustment of the GDP growth target was made against the backdrop of a slowing global economy, as several international organisations have recently lowered their forecasts for global growth this year.

The 6.6-per cent GDP growth rate in 2018 did not come by easily, and the 6-6.5 per cent target is going to be a growth on top of a very large base figure, he said.

“Keeping steady growth of China’s economy in itself is an important progress,” he said.

He said China has over 100 million market entities, whose vitality will create incalculable energy once fully unleashed and reiterated that China will continue to cut taxes and fees, streamline administration, foster new drivers of growth, broaden market access, and level the playing field for all market players.

Li said China has policy room reserved for dealing with possible uncertainties this year such as raising the deficit-to-GDP ratio, or using other instruments like required reserve ratios and interest rates.

“We are not going for monetary easing, but trying to provide effective support to the real economy,” Li said.

“China’s economy will remain an important anchor of stability for the global economy,” Li said.

In order to keep the country stable China will ensure the creation of more than 11 million new urban jobs this year, he said.

“In actual practice, our goal is to generate the same amount of job opportunities as we did last year, which is over 13 million,” Li said.

“This year, for the first time, we are elevating the status of employment-first policy to a macro policy together with the fiscal policy and monetary policy,” Li said.

“Keeping our major economic indicators within a proper range is first and foremost about ensuring employment and preventing a surge in unemployment,” he said, adding that the country will adopt a combination of measures to boost employment.

Li said the country will work to ensure employment of college graduates, whose number will reach a new high of 8.34 million this year. It will prevent zero-employment families and provide more policy support to companies that hire more people.

The country will encourage business start-ups and innovation to create more job opportunities, he said. PTI