Verifying your vehicle insurance status online is a convenient process that enables you to stay informed. A valid insurance policy acts as a shield. It protects you from any liabilities arising from accidents, theft, or damage to your car. Knowing your insurance status online ensures you’re driving with confidence. This can help you avoid potential penalties for expired coverage and the stress of an unexpected situation.

Methods for Online Vehicle Insurance Status Checks

There are several methods for checking your vehicle insurance status online. Here’s a breakdown of the most common approaches:

- Your Insurance Company’s Website

Most insurance companies offer a secure online portal for their policyholders. You can access your policy details by logging in with your registered credentials. These include the expiry date, coverage type, and any add-on covers included in your plan. If you’re unsure about your login credentials, refer to your policy documents. Alternatively, you can contact your insurance company’s customer service for assistance. Many insurance companies also offer mobile apps that allow you to access your policy information and check the status on the go.

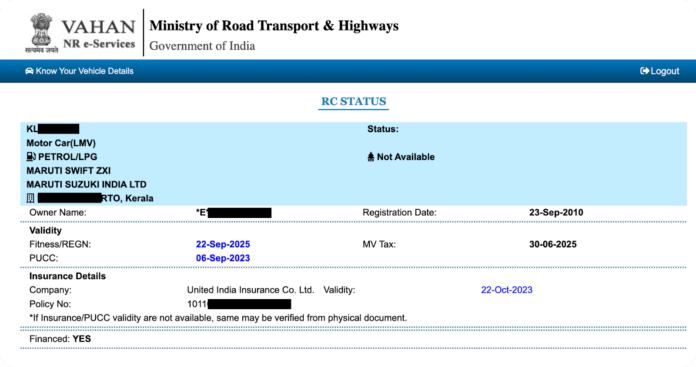

- The Parivahan Sewa Website

The Parivahan Sewa, also known as the VAHAN e-Services portal, is a government-run website. It provides a range of vehicle-related services, including checking insurance status. To utilise this method, you’ll need your vehicle’s registration number. The VAHAN e-Services portal is a valuable resource for car owners in India. It offers easy access to various vehicle-related information. This includes registration details, pollution certificates, and a copy of your registration certificate.

- The Insurance Information Bureau (IIB) Website

The IIB is an industry body that maintains a database of vehicle insurance policies in India. It doesn’t offer direct access to policy details for individual car owners. However, it provides a platform to verify the insurance status of a vehicle using the registration number. This method can be helpful if you need to confirm the insurance coverage of another car involved in an incident. It is also useful if you’re looking to buy a pre-owned car and want to verify its insurance status.

Choosing the Right Method

The most suitable method for checking your vehicle insurance status online depends on several factors. These include:

- Your Comfort Level

If you’re comfortable using your insurance company’s online portal, this might be the quickest option. Some insurance companies offer features like managing claims online and requesting roadside assistance. They can even help you make policy payments directly through their portals.

- Accessibility

The Parivahan Sewa website and the IIB website are accessible to those with an internet network. This can be beneficial if you don’t have immediate access to your insurance company’s portal. It is also useful if you’re checking the insurance status of a vehicle that doesn’t belong to you.

- Information Needs

If you simply need to confirm if your insurance is active, any of the mentioned methods will suffice. However, if you want to review the specifics of your policy, your insurance company’s portal will provide the right information.

Tips for a Smooth Online Check

Here are some tips to ensure a smooth and successful online vehicle insurance status check:

- Gather Information

Before initiating the online check, have your vehicle’s registration number handy. This is typically a unique alphanumeric code displayed on your car’s registration certificate. Keeping a digital copy of your registration certificate on your phone can be helpful for quick access.

- Stable Internet Connection

A stable internet connection is essential for accessing online portals. If you’re using a public Wi-Fi network, be cautious about entering your personal information. Ensure the website uses a secure connection (indicated by a lock symbol in the address bar).

- Review Policy Details

While checking your insurance status, take a moment to review your policy details. This might include your coverage type (third-party liability only, comprehensive, etc.), expiry date, and any add-on covers included in your plan (engine protection, zero depreciation cover, etc.). Familiarising yourself with your policy details enables you to make informed decisions. This can be about renewing your coverage or upgrading your plan in the future.

- Update Contact Information

Ensure your contact information is up-to-date in your insurance company’s records. This allows them to reach you easily for any policy-related communication. This can be renewal reminders, claim updates, or important policy changes.

- Bookmark Important Websites

You can bookmark the websites of your insurance company, the Parivahan Sewa portal, and the IIB website for easy access. This can save you time searching for the links online whenever you need to check your insurance status and more.

- Set Renewal Reminders

Many online calendars and to-do list applications allow you to set reminders. Utilise this feature to set a reminder for your insurance policy renewal before the expiry date. This approach ensures you have time to compare quotes or renew your existing policy. It can also be useful for exploring new insurance options if needed.

The Benefits of Regular Online Checks

Checking your vehicle insurance status online periodically offers several advantages:

- Early Renewal Reminders

A timely online check can alert you to an approaching policy expiry. This allows you to renew your coverage seamlessly and avoid any lapse in insurance. A lapse can leave your car financially unprotected. It might even result in penalties or difficulties when renewing your policy.

- Peace of Mind

Knowing your insurance is valid and active provides peace of mind while driving. You can be assured that you’re financially protected in case of unforeseen events. These can be accidents, theft, or damage caused by natural disasters.

- Avoiding Penalties

Driving with an expired insurance policy can attract penalties from traffic authorities. Regular online checks help you avoid such situations. It can also help ensure you’re compliant with traffic regulations.

- Improved Claims Processing

A valid insurance policy with an up-to-date registration ensures smoother claims in the event of an accident. You can avoid delays or complications during the claims settlement process. This can be done by keeping your insurance company informed of any changes to your vehicle or contact information.

By incorporating these methods and tips into your routine, you can ensure your car is adequately insured. Taking a few minutes to check your insurance status online can prevent unexpected hassles. It can then ensure a smoother and more secure driving experience.

Also Read: Road Trips Are More Secure Than Ever. Get the Road Trip Cover on Bajaj Markets