MUMBAI: Shares of Adani Group firms continued with losses as the stock market opened on Friday. The Gautam Adani-led group’s assets had been declining since last week after Hindenburg Research came out with a damaging report on the various activities of the conglomerate.

In the morning session of Friday, key indices Sensex went up 236 points to 60,185.49 while NSE Nifty50 gained 17 points to 17,627.80 level. Financial stocks were gaining ground in the morning.

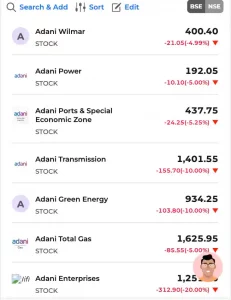

Shares of Adani Group’s flagship firm, Adani Enterprises, were down 27.47 per cent to Rs 1,143.50 apiece on Friday morning. According to data available, in just five sessions, it has lost more than Rs 1,926.55 or declined over 62 per cent. Adani Green’s shares declined 10 per cent to Rs 935.90 apiece, while it lost Rs 392.30 or declined 29.54 per cent in just five days.

Adani Ports and SEZ lost Rs 39.95 or dropped 8.12 per cent to Rs 424.90 on Friday morning. The firm’s shares had lost more than Rs 227.20 or 35 per cent in a period of five days. Adani Transmission shares dropped 10 per cent flat to Rs 1,396 apiece in the morning trade on Friday. The firm had lost Rs 371.25 or dropped 21 per cent in just 5 days.

FMCG firm Adani Wilmar dropped 5 per cent to Rs 399 apiece on Friday morning while it lost Rs 91 or dropped more than 18.54 per cent in a span of five days. In another development, Adani Group is said to have made scheduled coupon payments on outstanding US dollar-denominated bonds on Thursday, according to Reuters, which quoted a source with direct knowledge of the conglomerate’s strategy.

The payments were made as Adani Group, led by Indian billionaire Gautam Adani, as the group battles with a rout in its stocks in India and its US bonds after last week’s critical report by the US short-selling firm.

The group entities made scheduled coupon payments on outstanding US dollar-denominated bonds on Thursday, according to Reuters’ source with direct knowledge of the conglomerate’s strategy. Adani Ports and Special Economic Zone Limited paid coupons, the two sources of Reuters, speaking on condition of anonymity, said.

The source with knowledge of the firm’s strategy said Adani Transmission also processed bond payments on Thursday. Adani Group plans to issue a credit report by today which will address concerns raised by the Hindenburg report about its liquidity, according to Reuters’ source. According to Reuters, the Adani Group did not respond to a request for comment. Calculations showed that interest payments of a total of around USD 24 million were due on February 2 on three bonds issued by Adani Ports and Special Economic Zone due to mature in 2031, 2032 and 2041.

The conglomerate’s dollar bonds slipped further into losses on Thursday, a day after its flagship Adani Enterprises called off a USD 2.5-billion share sale in a shock move, the report said. Adani Green’s bonds maturing in September 2024 led the losses, falling 11.69 cents, to 60.56 cents, their lowest since issuance, according to Reuters.

The US dollar-denominated bonds of Adani Ports and Special Economic Zone, Adani Transmission and Adani Electricity Mumbai were also trading lower, the report added. (ANI)

Also Read: Houses adjourned to stop Oppn from raising Adani issue: Jairam