Vidya Sethuraman

India Post News Service

Every day people report to the FTC the scams they spot. Every year, the FTC shares the information we collect in a data book, which tells a story about the top scams people tell us about – so we can all spot and avoid them. Ethnic Media services (EMS) held an online conference on the Feb 9th, and specially invited experts from the Federal Trade Commission (hereinafter referred to as FTC) to introduce the latest fraud data for 2023, including the most common fraud techniques and how to report them.

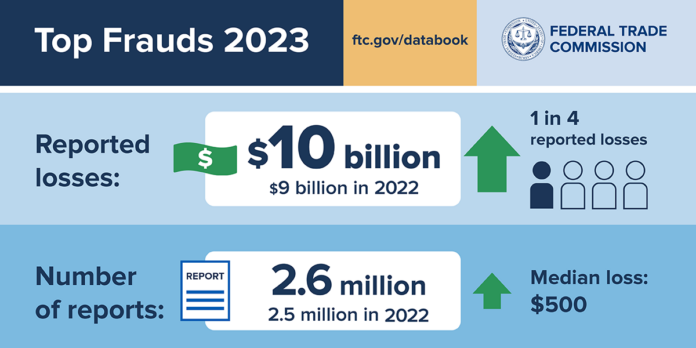

Maria Mayo, Acting Associate Director for the Division of Consumer Response and Operations in the Bureau of Consumer Protection at the Federal Trade Commission said the data book tells us that people lost $10 billion to scams in 2023.

That’s $1 billion more than 2022 and the highest ever in reported losses to the FTC – even though the number of reports (2.6 million) was about the same as last year. One in four people reported losing money to scams, with a median loss of $500 per person. And email was the #1 contact method for scammers this year, especially when scammers pretended to be a business or government agency to steal money.

The top five most common fraud methods in 2023 are pretending to be a person or an organization to defraud, online shopping, fake lottery winning information, investment, and defrauding through business and job opportunities. Unexpectedly, the most common platform for contacting victims in 2023 is email, followed by phone calls, text messages, websites or apps, and social media. She said that in previous years the most common methods of contact were calling and sending messages, but in 2023 it was through email.

Lois Greisman, Associate Director, Federal Trade Commission Division of Marketing Practices, Washington DC said that in recent years, artificial intelligence has been widely used in fraud. Scammers impersonate the voices of relatives and friends of the victims and call them to defraud them of money. Scammers can also use artificial intelligence to analyze the most successful methods of deception.

Larissa Bungo, Senior Attorney, Division of Consumer & Business Education, Federal Trade Commission, Washington DC explains how to report a scam. She said victims can report whether they have been defrauded of money or not. Currently, telephone reporting supports multiple languages, including Spanish, Chinese, Vietnamese, etc. The phone number is 8773824357. After dialing, press “3” to select the corresponding language. The reporting hotline operates from 9 a.m. to 5 p.m. Eastern Time. People can also make reports online, in English and Spanish, at: https://reportfraud.ftc.gov/.

Here are other takeaways for 2023:

Imposter scams – Imposter scams remained the top fraud category, with reported losses of $2.7 billion. These scams include people pretending to be your bank’s fraud department, the government, a relative in distress, a well-known business, or a technical support expert.

Investment scams – While investment-related scams were the fourth most-reported fraud category, losses in this category grew. People reported median losses of $7.7K – up from $5K in 2022.

Social media scams – Scams starting on social media accounted for the highest total losses at $1.4 billion – an increase of 250 million from 2022. But scams that started by a phone call caused the highest per-person loss ($1,480 average loss).

Payment methods – How did scammers prefer that people pay? With bank transfers and payments, which accounted for the highest losses ($1.86 billion). Cryptocurrency is a close second ($1.41 billion reported in losses).

Losses by age – Of people who reported their age, younger adults (20-29) reported losing money more often than older adults (70+). However, when older adults lost money, they lost the most.

Also Read: The FTC breaks through language barriers to reach consumers targeted by fraud