NEW DELHI: Although the Coronavirus’ impact on the US economy has been profound, the result of the upcoming presidential election in November is likely to have a significant effect on the global economy in the next four years.

The current pandemic and an uncertain economy have added new importance to an already volatile US election cycle. According to a report by Sucden Financial, a US firm in commodity futures and options trading, however, the critical outcome is mostly straightforward: the overall government election outcome will matter more than any candidate’s success.

It said a divided/unified government will be a better predictor of future policies than the winning party. The Senate race is as important as the Presidential election. A unified government will mean that either candidate will be able to follow through on their main campaign pledges or see at least two more years of deadlock. In some respects, there is a benefit to some assets from a divided government, it said.

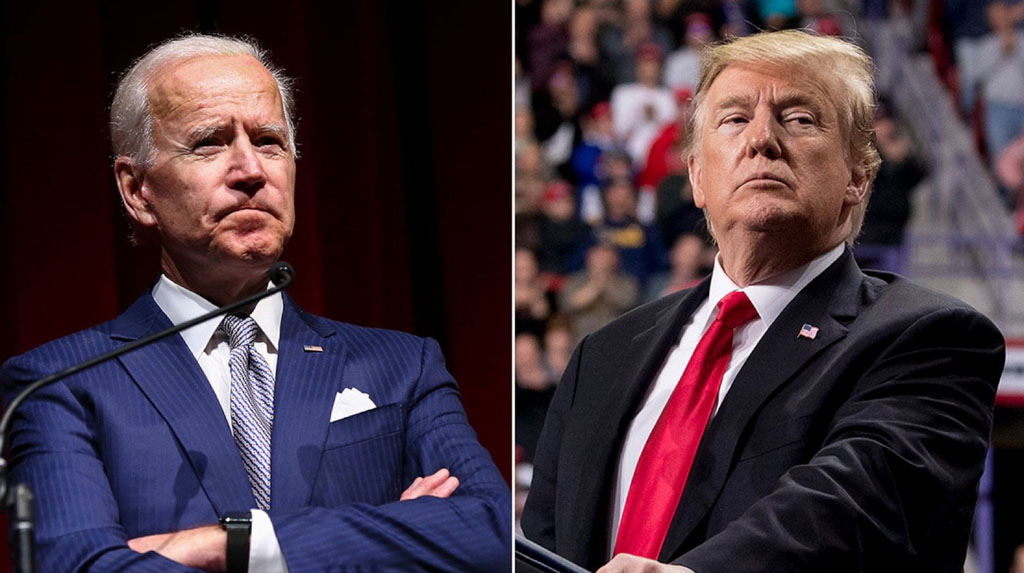

While policies of Joe Biden vs. Donald Trump will differ significantly, both are likely to be big spenders. “Indeed, we believe that both candidates can enact policy that will have a positive economic impact to revive the economy from the Covid-19 crisis, which could support the dollar, at least in the short-term,” the report said.

Indeed, despite the candidates’ different long-term ambitions for the US’ global role, the election outcome should not significantly change the country’s medium-term outlook.

Both candidates are likely to focus on recovering the economy from the deepest recession since the start of the record-keeping. Record unemployment and fiscal spending to lessen the pandemic’s impacts are likely to remain the key objectives for the US economy.

As per the report, for Biden’s win, this would imply that his administration would be more focused on safeguarding the recovery rather than delivering on his campaign pledges, at least at the beginning of his term. If Trump wins, we expect his second term to be less disruptive and polarising than the first one. The potential for surprises should be much lower, mostly if Congress remains divided, it added.

Fulfilling campaign pledges depends mostly on the outcome in the Senate. Should the Congress remain divided, this could significantly dampen the outlook for the US economy. As for the dollar’s impact, either result would leave the currency weakening trend in place, and a Biden victory could accelerate this depreciation. Given his term poses less geopolitical risks, the dollar volatility could fall and could be based more on the fundamentals rather than presidential statements.