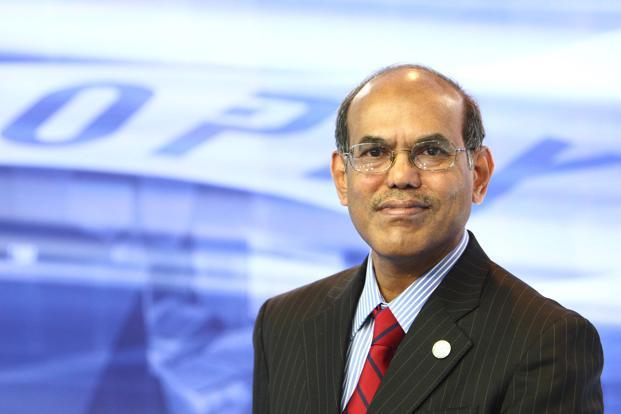

SINGAPORE: Former Reserve Bank of India (RBI) governor Duvvuri Subbarao today said Finance Minister Arun Jaitley’s decision to relax on fiscal consolidation to give himself more room to spend is a questionable and by far the most disappointing decision of the budget.

SINGAPORE: Former Reserve Bank of India (RBI) governor Duvvuri Subbarao today said Finance Minister Arun Jaitley’s decision to relax on fiscal consolidation to give himself more room to spend is a questionable and by far the most disappointing decision of the budget.

He cautioned that every time finance ministers hit the “pause” button on fiscal consolidation, whether it is the UPA government or the NDA government, they have justified it on the ground that “this time is different”.

“And every time they paused, they promised that, henceforth, they will be disciplined. But every time, the macroeconomic costs of departing from fiscal virtue have been heavy.

“What is even more worrying than the size of the fiscal deficit is the laxity on revenue deficit which has ballooned,” said Subbarao, a Distinguished Visiting Fellow at the National University of Singapore (NUS), at a panel discussion on the Indian budget, organized by the Institute of South Asian Studies, a varsity think tank.

He said that an argument can be made for higher borrowing by the government, if the additional borrowing is used for capital formation.

“But that is not the case. Almost the entire net additional borrowing of the centre is going towards servicing the higher interest burden. “If we add in the fiscal situation of the states, the combined fiscal picture is worrisome,” said the former RBI governor, who held the post between 2008 and 2013.

He said that the finance minister inherited a fiscal deficit of 4.2 per cent of GDP and he brought it down to 3.5 per cent. But this was at a time when oil price was low and food prices were soft because of good monsoons.

“Now, when oil prices are hardening and the current account deficit is inching up, fiscal discipline becomes even more imperative”, he added.

“In a vigorous democracy like India, there is always clamor for higher spending by the government. But in the long run, it pays to be ‘wooden-headed’ about fiscal consolidation,” he pointed out.

Subbarao commended the proposed national health insurance program, while pointing out that the welfare outcomes will depend on how the program is designed and implemented.

He also appreciated the measures contained in the budget to bring in convergence across schemes to improve outcomes such as the proposal to develop 22,000 village agricultural markets folding in funds from the rural roads and rural employment programs.

“These might look trivial from the vantage point of Delhi, but the pay off this convergence at the field level can be big,” he said.

Subbarao was, however, disappointed with the finance minister’s decision to slap customs duty on about 50 items.

“Whether this will raise employment is uncertain, but it will surely hurt consumers through higher prices,” he said.

This decision runs counter to the calibrated reduction in import tariffs over two decades, and runs counter also to the prime minister’s speech in Davos just two weeks ago where he decried the growing protectionist tendencies in the rich world, he added.

“Not walking the talk raises a credibility gap which will hurt India’s investment prospects,” said Subbarao.

Referring to the finance minister’s admission that the increase in the number of income tax returns has not resulted in commensurate higher tax yield, Subbarao suggested that the government should commission an independent study on the costs and benefits of demonetization.

This, he said, will be useful as a policy guide for the future.-PTI