Directors and Officers Insurance is a liability that protects directors and employees of the company from claims that may arise due to any decision or action made while on duty. This insurance covers legal defence costs, i.e. costs incurred by the company to defend itself against lawsuits.

The wrongful acts include:

- Breach of trust, breach of duty

- Misleading or misstatement

- Defamation, Act of omission/ negligence.

- Inappropriate workplace conduct like discrimination, defamation, sexual harassment, failure to promote, etc.

- Claim solely because of their status.

Directors and officers are legally bound and responsible by duty towards stakeholders, such as shareholders, creditors, employees, competitors, customers, and government bodies. A breach or non-compliance can lead to the raising of claims against directors and officers on account of the wrongful act. They will be bound to incur some expenses, such as damages and compensation, along with other incidental costs. It can affect a company’s growth and performance. The Directors and Officers Insurance will protect against expenses, claims, and losses.

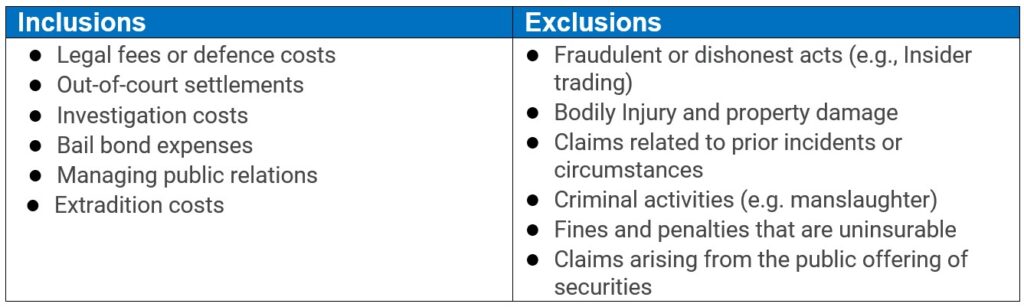

Inclusions and Exclusions

Who is Insured?

The policy offers broad coverage, encompassing a range of individuals within the company, such as:

- Executive directors Company secretaries

- Non-executive directors

- In-house lawyers

- Shadow directors Risk managers Prospective directors

- De facto directors

- Any member of the supervisory or management board Employees in key management roles e.g. CTO, CFO, CMO, CXO

Types of Directors and Officer’s Liability Insurance

The main 3 types of insuring agreements are Side A, Side B, and Side C. Let us discuss them in detail:

- Side A:

It includes claims where directors and officers decline or are unable to pay financially for indemnification. Let us say a company is declared bankrupt, so in the case of “Side A” insurance coverage, the officer will be insured, and their personal assets will be at risk.

- Side B:

It includes the losses incurred when the company provides indemnification. The policy will then be reimbursed for legal costs, and the corporate assets are at risk while the company is insured.

- Side C:

Here, the company itself is insured, and corporate assets are at risk.

Conclusion

Directors and Officers (D&O) Insurance offers financial protection to the company’s leaders against any personal liability arising due to their actions done in their professional capacity. It protects them from regulatory investigations, lawsuits, and claims to mitigate the risks faced during their leadership.