MUMBAI: The Reserve Bank of India (RBI) on Friday massively reduced the key lending rates in response to the Covid-19 outbreak.

Accordingly, the Monetary Policy Committee of the central bank in an unscheduled meet reduced the repo rate, the key interest rate at which the RBI lends short term funds to commercial banks, by 75 basis points to 4.40 percent from 5.15 percent.

Consequently, the reverse repo rate was also reduced by 90 basis points to 4 percent.

Besides, the marginal standing facility (MSF) rate and the Bank Rate stand reduced to 4.65 percent from 5.40 percent.

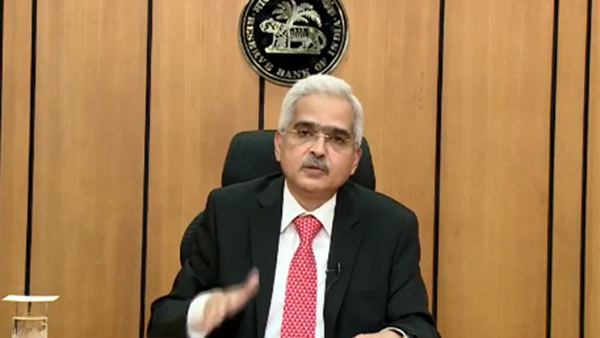

“The purpose of this measure relating to reverse repo is to make it relatively unattractive for banks to passively deposit funds with the Reserve Bank, and instead to use these funds for lending to the productive sectors of the economy,” RBI Governor Shaktikanta Das said.

“This decision and the announcement of the MPC has been warranted by the disruptive force of the kernel riders. It is intended to mitigate the negative effects of the riders to revive growth and, above all, number three, to preserve financial stability,” he said.

“The time has now come for the Reserve Bank to unleash an array of instruments from its arsenal to mitigate the impact of Covid-19 and, above all, preserve financial stability.” Furthermore, the MPC voted to maintain an accommodative stance, thus opening up possibilities for more future rate cuts.

In another major step, the Apex bank instituted a moratorium on interest payments for three months.

On the outlook side, the RBI said that recovery in 2020 from 2019’s decade low in global growth have been dashed. “The outlook is now heavily contingent upon the intensity, spread and duration of the pandemic. There is a rising probability that large parts of the global economy will slip into recession,” the RBI said in a statement.