Suppose you’re a homeowner with an existing home loan. In that case, you might need additional funds for various reasons such as home renovations, medical emergencies, education, or even to consolidate high-interest debt. In such cases, a top-up loan on your home loan can be a convenient and cost-effective solution. In this article, we’ll explore the benefits of opting for an instant home loan top-up and why it might be the right choice for you.

What is a Home Loan Top-Up?

A home loan top-up is an additional loan amount that you can borrow over and above your existing home loan. This option is available to existing home loan borrowers who have a good repayment track record and sufficient equity in their property. The process of obtaining a top-up loan on your home loan is usually simpler and faster compared to applying for a new loan.

Benefits of an Instant Home Loan Top-Up

- Quick and Easy Access to Funds

One of the primary advantages of a home loan top-up is the speed and ease with which you can access additional funds. Since you are already a customer of the lending institution and have a proven repayment history, the approval process is typically faster and requires less documentation. This is especially beneficial in urgent situations where you need immediate funds.

- Lower Interest Rates

Top-up loans on home loans generally come with lower interest rates compared to personal loans or credit cards. This is because the loan is secured against your property, reducing the risk for the lender. Lower interest rates mean lower EMIs (Equated Monthly Installments) and overall savings on interest payments over the loan tenure.

- Flexible Repayment Options

Home loan top-ups offer flexible repayment options, allowing you to choose a tenure that suits your financial situation. You can align the repayment period with your existing home loan or opt for a different tenure based on your repayment capacity. This flexibility helps in better financial planning and management.

- No Restriction on End Use

One of the significant advantages of a home loan top-up is the lack of restrictions on the end use of the funds. Unlike some loans that are designated for specific purposes (e.g., car loans, education loans), the money from a top-up loan can be used for any personal or professional need. Whether it’s renovating your home, funding a wedding, or starting a business, you have the freedom to use the funds as you see fit.

- Higher Loan Amounts

Since top-up loans are secured against your property, lenders are often willing to offer higher loan amounts compared to unsecured loans. The loan amount you can avail depends on the current market value of your property, the outstanding balance on your existing home loan, and your repayment capacity. This makes it an ideal option if you require a substantial sum of money.

- Tax Benefits

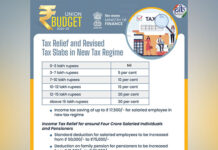

In some cases, you may be eligible for tax benefits on the interest paid on a home loan top-up, provided the funds are used for home renovation, construction, or purchase of a residential property. However, it’s important to consult with a tax advisor to understand the specific benefits applicable to your situation.

How to Apply for a Home Loan Top-Up

Applying for a top-up loan on your home loan is a straightforward process. Here are the general steps involved:

Check Eligibility: Ensure you meet the lender’s eligibility criteria, which typically include a good repayment track record, sufficient equity in your property, and a stable income.

Documentation: Gather the necessary documents such as identity proof, address proof, income proof, and property documents. Since you already have an existing relationship with the lender, the documentation requirements may be minimal.

Application: Submit the application form along with the required documents to your lender. Some lenders also offer online application facilities for added convenience.

Processing and Approval: The lender will review your application, verify the documents, and assess your repayment capacity. Once approved, the funds will be disbursed to your account, often within a few days.

Conclusion

Opting for an instant home loan top-up can be a smart financial move when you need additional funds. With benefits such as quick access to funds, lower interest rates, flexible repayment options, and no restrictions on the end use of the money, a top-up loan on your home loan offers a convenient and cost-effective solution. Ensure you understand the terms and conditions and choose a reputable lender to make the most of this financial product. With careful planning and responsible borrowing, a home loan top-up can help you achieve your financial goals and provide the funds you need with minimal hassle.