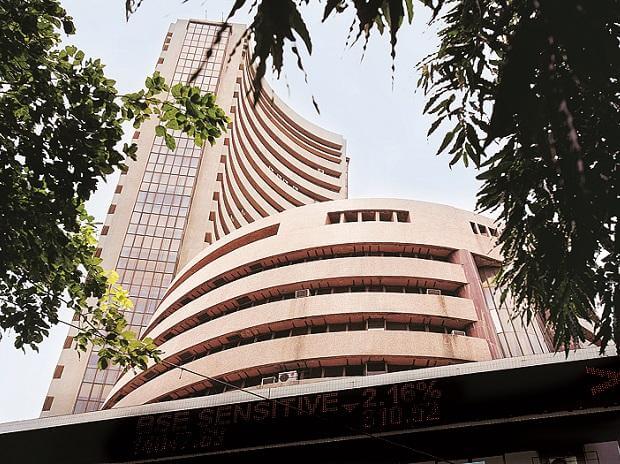

NEW DELHI: The first half of financial year 2021, April-September, has turned out to be the best first half for Nifty in the last decade, aided by low base post the correction in March. Motilal Oswal Institutional Equities said in a report that the market rally is more broad-based as the Nifty has given best 6-month return since October 2009.

The 12 month price performance differential between the Nifty 50 v/s the Nifty’s Equal weight index indicates that the market rally has been more broad-based over the past six months. 1HFY21 has turned out to be the best 1H for the Nifty in a decade with the Nifty delivering 31 per cent returns, the report said.

The broad-basing of markets after almost three years of polarization augurs well as the recovery in underlying economy takes shape, it added.

Mid and Small-Cap indices have once again outperformed Nifty in September. In the BSE-200, BFSI dominates list of laggards in calendar year 2020 year to date. 53 per cent of BSE-200 companies yielded negative returns in September while in year to date, 59 per cent of BSE-200 constituents declined and financials were the major laggards.

In the BSE-200 index, 21 stocks up more than 10 per cent in September, 63 stocks up more than 10 per cent year to date. 94 out of BSE-200 constituents gained in September with 21 stocks posting more than 10 per cent gains. In the year, 82 BSE-200 constituents gave positive returns with 34 stocks returning more than 30 per cent, 20 of these 34 stocks are either tech or pharma.

In the Nifty, year to date top three performers are pharma majors. In CY20 YTD, 20 Nifty stocks have delivered positive returns with Reddy’s and Divi’s gaining 80 per cent and 65 per cent, respectively. The report says 22 per cent of Small-cap companies have doubled since March lows. 11 per cent of Large-cap companies and 14 per cent of Mid-cap companies have more than doubled since March.

Covid has resulted in Bank Nifty’s relative outperformance versus Nifty to collapse. Bank Nifty had outperformed the Nifty over March 2016 to December 2019. However, the entire outperformance has been wiped out over the last six months as the BFSI segment is facing the maximum brunt of the Covid-19 pandemic. The Nifty-50’s market cap is at an all-time high now. However, the Nifty Mid-cap 100’s market cap is still down 24 per cent from its peak, although it is above December 2019 level.