In the years following the pandemic, the way businesses in India handle payments has undergone a significant transformation. As consumer expectations shifted towards contactless and digital-first experiences, the role of payment gateways in this change has become indispensable.

Payment gateways in India have not only simplified the process of making transactions but have also enabled businesses to enhance their customer service, increase operational efficiency and scale rapidly. In this blog, we will discuss how payment gateways in India are empowering businesses in India to adapt to the growing demand for digital payments.

The rise of digital payments in India

Digital payments in India have seen a significant rise, reshaping how businesses and consumers transact. Reports show that the country’s digital payments ecosystem grew by nearly 63% in 2020, driven by greater internet access, increased smartphone usage and a growing preference for cashless transactions. To keep up with changing customer expectations, more businesses turned to online payment solutions. This shift created a strong demand for seamless, secure and reliable payment gateways, making them an essential part of modern commerce.

Payment gateways: The backbone of digital transactions

A payment gateway in India connects a business to its customers, ensuring the secure transfer of payment information between both parties. These platforms facilitate a wide range of digital payment methods, including credit/debit cards, mobile wallets, net banking and UPI (Unified Payments Interface).

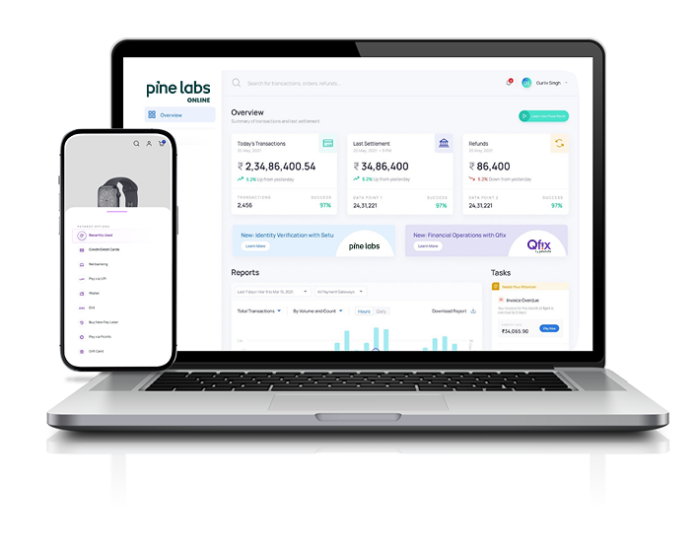

As online shopping, service subscriptions and remote transactions rise, the payment gateways in India have become essential for offering businesses a secure, efficient and seamless payment experience. Payment gateways are now equipped with advanced features that allow businesses to process payments in real time, manage subscriptions and even offer auto-renewal options—all from a single platform. The seamless integration of these gateways has helped businesses pivot to a fully digital model, making transactions more straightforward and hassle-free for both parties.

Enhancing customer experience with secure transactions

A major reason businesses are adopting digital payment solutions is the need for a secure transaction environment. Payment gateways in India offer strong encryption and fraud protection mechanisms, ensuring that sensitive customer data remains safe. As fraud tactics grow more advanced, businesses must strengthen security to protect customer trust. The rise in mobile payments, particularly UPI, has also contributed to this security-focused shift. With over 4.3 trillion UPI transactions recorded in 2020, UPI has gained the trust of millions of users by providing an easy, safe and fast way to transfer money.

Payment gateways that integrate UPI functionality are facilitating a more secure payment method for businesses and consumers alike. These gateways are constantly adapting to meet global security standards, helping businesses stay compliant with regulations while ensuring a safe environment for their customers.

The role of payment gateways in business scalability

Scalability is essential for businesses looking to expand. Payment gateways in India provide businesses with the flexibility needed to scale their operations rapidly and efficiently. The integration of payment systems into a business’s website or mobile app requires minimal effort, which significantly reduces setup time and resource allocation.

Additionally, payment gateways in India allow businesses to support multiple currencies, languages and payment methods, thus broadening their reach. This scalability ensures that businesses can tap into new markets and customer segments with ease without needing to overhaul their payment infrastructure.

Streamlining operations with automated payments

The digital shift has also enabled businesses to streamline their operations by automating payments. Payment gateways in India are designed to handle recurring payments and subscriptions with ease. This functionality has proven to be invaluable for businesses offering subscription-based services, such as SaaS products, content platforms and e-commerce retailers.

By automating payments, businesses can reduce human error and save time on manual processing. This automation not only streamlines cash flow but also enables businesses to concentrate on growth and enhancing customer satisfaction. Furthermore, the integration of payment gateways with accounting and CRM systems provides businesses with a more accurate and real-time view of their financial status.

Meeting customer expectations with diverse payment methods

As digital trends change, so do consumer preferences. Consumers now expect multiple payment options, and businesses must keep up with these demands. Payment gateways in India enable businesses to offer a selection of payment methods, including card payments, digital wallets and UPI.

Offering these diverse payment options not only attracts more customers but also reduces cart abandonment rates. A study by Baymard Institute revealed that 13% of online customers leave their carts behind due to insufficient payment options. Payment gateways help mitigate this issue by providing businesses with access to multiple payment channels, ensuring that customers can complete transactions using their preferred method.

The impact of payment gateways on cash flow management

Payment gateways in India offer real-time tracking and reporting features that give businesses better visibility into their cash flow. These tools allow businesses to monitor payments, track outstanding invoices and reconcile accounts efficiently. Real-time payment tracking allows businesses to manage their finances more efficiently and prevent any possible cash flow issues.

With the rise of digital payments, businesses no longer need to wait for days for cheques to clear or for payments to be processed manually. Payment gateways enable businesses to receive instant payments, which helps maintain liquidity and ensures the smooth operation of daily activities.

Adapt to the changing world of payments

The growing reliance on payment gateways has accelerated the shift towards digital payments in India. These gateways have made it easier for businesses to accept payments securely, scale operations and enhance customer satisfaction. As digital transactions become the norm, businesses must integrate efficient payment solutions to stay competitive.

With their easy API integration and success in ensuring smooth and secure transactions, payment gateway providers like Plural are helping businesses make the digital shift more effortlessly. They empower businesses to adapt to the changing world of payments.

Also Read: What are the advantages of using a scalable Android PoS system in hospitality?