NEW DELHI: India definitely is not a destination for sports tourism as yet but Indians are surely travelling a lot to witness big-ticket events, a fact which has excited leading financial services providers such as Mastercard.

NEW DELHI: India definitely is not a destination for sports tourism as yet but Indians are surely travelling a lot to witness big-ticket events, a fact which has excited leading financial services providers such as Mastercard.

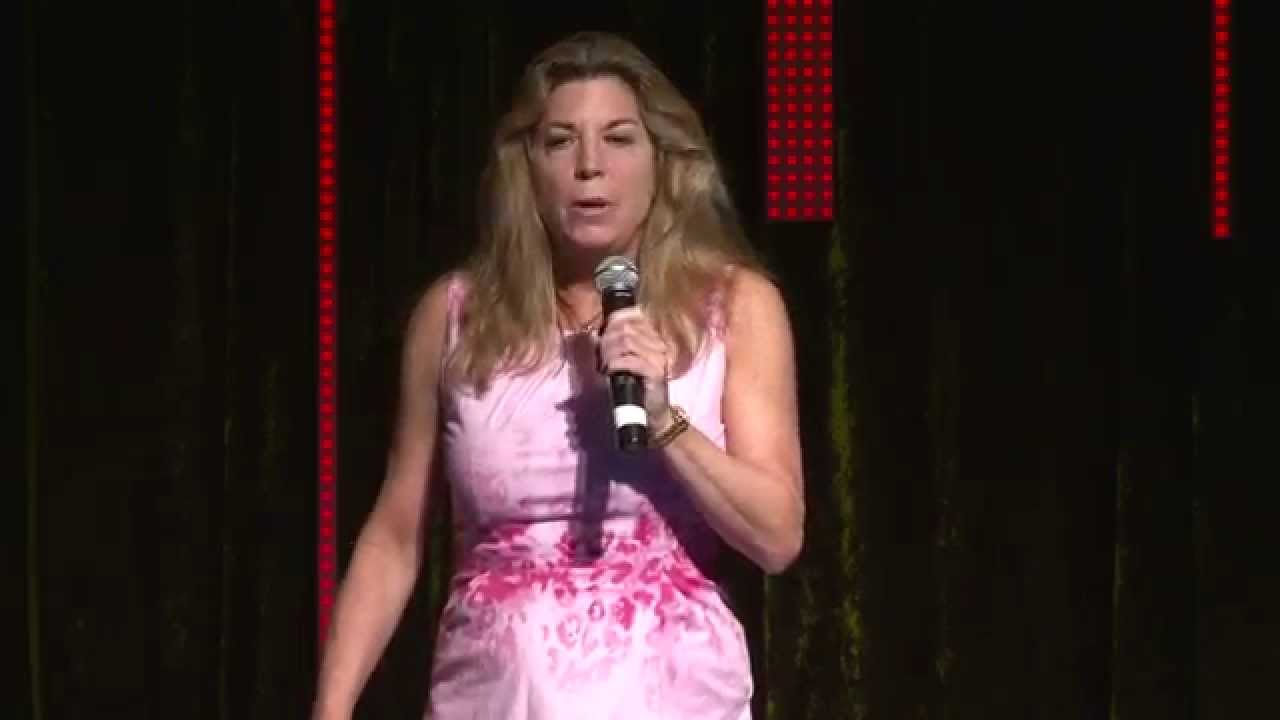

Sarah Quinlan, the Senior Vice President and Group Head of Market Insights for Mastercard Advisors, said Indians are now travelling abroad with a purpose, including for sports events and it is encouraging for them.

“Indians are travelling and travelling with purpose. They are going around the world for tennis and cricket matches, football matches. There is clear demonstration that incomes are increasing and economy continues to improve within India,” Sarah told PTI in an interaction.

“There is determined travel as opposed to a vacation. I call it travel with a purpose. Indian consumer is responding. I wonder if the markets have caught what the consumer has demonstrated,” she added.

She, however, agreed that it will take some time for India to witness sports tourism in the country.

“Right now it is a low, single-digit percentage but interesting thing is to watch the growth in spending. The Indians have started travelling outside the country for this (sports tourism),” she said.

“There is an opportunity which has not been pursued. You don’t have to be a sporting nation, like in America we do buy a lot of athletic wear but that does not necessarily mean we use it. The point is we do travel for sports tourism.

“There is a real opportunity. The middle class continues to emerge in India for the industry to take advantage of it. From our perspective, any sort of commerce is good commerce. That is what we are trying to improve.”

Sarah said demonetization in India came as a “shock” to the industry but it proved to be highly beneficial for the digital payments sector.

The Indian government had demonetized all currency notes of 500 and 1000 denomination in 2016, claiming that it would help wipe off black money from the economy.

Sarah said the move was “interesting” and beneficial for them.

“It was quite a shock to the system initially. The best thing that came out of it was that we are still having net plus in digital transactions. There was a need and necessity at that time but it stayed up. We had double digit growth across the country last year. That’s exciting for all the players within industry,” Sarah explained.

“Our net plus was about 18 per cent. Right after demonetization it (digital transactions) was up by 30-35 percent but then it fell back, its natural. The key was not go back to the level before,” she added.-PTI