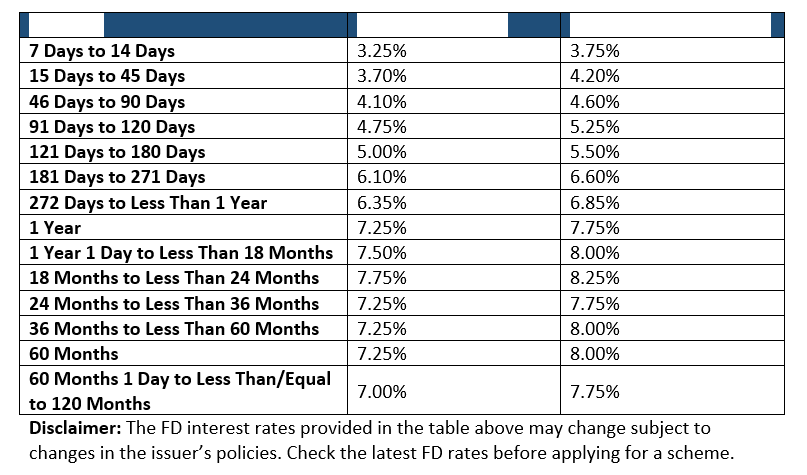

In November 2023, YES Bank increased FD interest rates of specific tenors for all deposits below ₹2 Crores. The revised rates have been made applicable with effect from November 21, 2023. With the 25 basis points increase, YES Bank FD interest rates for regular citizens currently range between 3.25% – 7.75% and 3.75% – 8.25% for senior citizens.

YES Bank FD Interest Rates

Check the table below to know about the latest YES Bank FD interest rates:

Key Features of YES Bank Fixed Deposits

Key Features of YES Bank Fixed Deposits

Here are some more features of YES Bank fixed deposits:

- Overdraft facility of up to 90% on the deposit amount; offering quick access to invested funds

- Option to reinvest maturity amount to enjoy the benefits of compounding interest

- Earn regular income by opting for monthly or quarterly payout options

- Auto-renewal facility is available

- Book an FD online from the convenience of home via YES Online, YES service portal, YES Robot, etc., as an existing customer

- Earn loyalty points in the form of YES Rewardz on booking a fixed deposit

Benefits of the YES Bank FD Interest Rate Hike

The increase in YES Bank FD interest rates provides several benefits to the potential investors:

Improved Returns

The increased interest rates will translate into higher earnings on your invested sum. This can make fixed deposits a more attractive investment if you are looking for wealth accumulation in the short or long term.

Competitive Rates

The revised rates are more competitive when compared to other private banks for certain tenors. You can compare these rates with other offers and make an informed decision for financial growth.

Flexibility

YES Bank offers different interest rates for varying tenors. The bank has decided to increase interest rates for tenors ranging between 7 days and 10 years. Hence, you can choose the investment duration as per your financial preferences and goals.

How to Calculate the YES Bank FD Interest

To compare the interest you can earn on YES Bank FD with other issuers, you can use a fixed deposit interest calculator. This is an online tool that lets you compute FD returns by entering simple inputs, which include:

- Deposit sum

- Selected tenor

- Interest rate offered by the issuer

This tool allows you to calculate your returns instantly so that you can compare multiple offers quickly and choose the ideal option. It also prevents manual errors and makes the process uncomplicated.

Along with comparing the interest, understanding what factors influence your FD rates is equally important. Some crucial factors include the current repo rate, monetary policies, and investment terms.

You should also assess the overall market conditions before you book an FD. During higher inflation, banks tend to offer higher interest rates on FDs. Thus, investing during this time will help you maximise your returns.

Also Read: Earn Assured Returns with Flexible Payouts; Invest in FDs on Bajaj Markets