The Insurance landscape has changed over the last few years. The demand for term plans, in particular, has risen rapidly due to the introduction of new threats globally. With medical emergencies, life-threatening illnesses, and even the need for financial support rising to the top of the list of concerns, term plans have quickly turned into the biggest boon of 2025. Let’s get to know the trends and how you can benefit from them.

What is a term plan?

Term plans are a form of life insurance policy that offers better benefits for a reasonable price.

Essentially, you start by selecting your coverage and policy tenure. For term plans, you can opt for a higher sum assured, ranging from as low as 25 lakhs to as high as 25 crores. You may also choose policy tenures from 10 to 100 years based on your health and expected mortality. It is the flexibility of these plans that appeals to young and old policyholders alike.

Term plans are available in many forms to serve various purposes, which are as follows:

- Increasing Term Plan – These term plans help beat the rate of inflation by compounding the original sum assured annually. The longer you survive the policy tenure, the higher the increase in the sum assured. In the event of your death, your beneficiaries receive a much higher death benefit than the one you chose when purchasing the policy.

- Decreasing Term Plan – These term plans help you settle a majority of your liabilities while securing your family’s future. Every year, the sum assured reduces by a preset amount. The difference is used to settle loans and debts. In the event of your death, the remaining sum assured is paid as a death benefit to your beneficiaries.

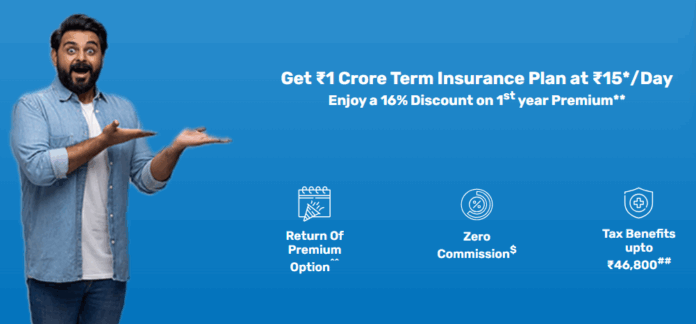

- Term Plan with Return of Premium – Normally, term plans don’t offer maturity benefits. However, if you choose a term plan with return of premium and survive the policy tenure, then you are entitled to the cumulative premiums that you paid over the years as a maturity benefit.

- Level Term Plan – There are no changes to these term plans. What you buy is what you get. In the event of your demise within the policy tenure, your beneficiaries will receive the amount for which you insured your life.

- Single Premium Term Plan – This is well-suited if you have an unstable source of income. You can pay a lump sum, single premium when you have the funds and insure your life with a term plan for a reasonable policy tenure.

These diverse forms of term plans play important roles in making financial decisions. They serve to support you as long as you live, and after your demise, they support your beneficiaries.

Term Insurance Key Trends in 2025

The world is changing rapidly, and the insurance industry is adapting to the growing needs and demands of humankind. In 2025, there are certain key trends that are shaping the term insurance landscape:

- Competition is high, so claim settlement ratios play a pivotal role. Every insurance company is striving harder to maintain a high claim settlement ratio that assures policyholders of trust and reliability. Despite the higher sum assured that term plans offer, the settlement numbers are rising for reliable insurers.

- Term plan with return of premium are becoming increasingly popular. Unlike most life insurance plans, term plans have limitations on benefits, such as earning profits or offering maturity benefits. The term plan with return of premium, however, is a winner in such situations. These policies offer the basic advantages of term plans, i.e., flexible tenure and higher sum assured. Term plan with return of premium also offers maturity benefits that act as excellent savings plans to see you through financial crunches.

- More and more insurers are opting for paperless term plan. That means you can apply for a term plan from the comfort of your home, submit the necessary documents online, and finish the verification process seamlessly. Apart from the convenience, this particular trend in 2025 is also environmentally conscious. Ergo, not only are you protecting the financial future of your loved ones but also helping in preserving the environment so they have breathable air.

- The Artificial Intelligence industry is also making a name in the world of term insurance. From application verifications to claim assessments, AI and Gen AI are making the process faster and easier for both companies and policyholders.

The economic climate of 2025 is also contributing to making term plans more accessible and reliable. With the rise in demand and competition and the holistic approach by insurance companies, term plans are easy solutions to protect yourself and your loved ones against financial instability.

Given the affordability of term plans, the added benefits in 2025 have turned them into key players in the life insurance world. The only thing you need to consider is which type of term plan works best for you and your loved ones.

Also Read: Bajaj Allianz General Insurance Introduces Two New Motor Insurance Offerings