India Post News Service

CHICAGO: The Cook County property owners have a free financial planning tool that can help them pay off their past-due property tax bills and avoid the “merciless” Annual Tax Sale, according to Treasurer Maria Pappas.

A Payment Plan Calculator at cookcountytreasurer.com is available at no cost to help property owners who are late paying their taxes.

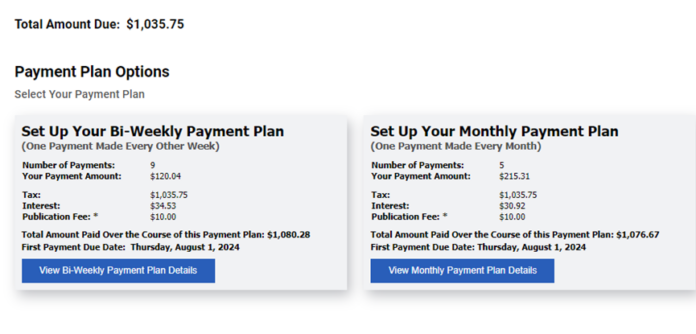

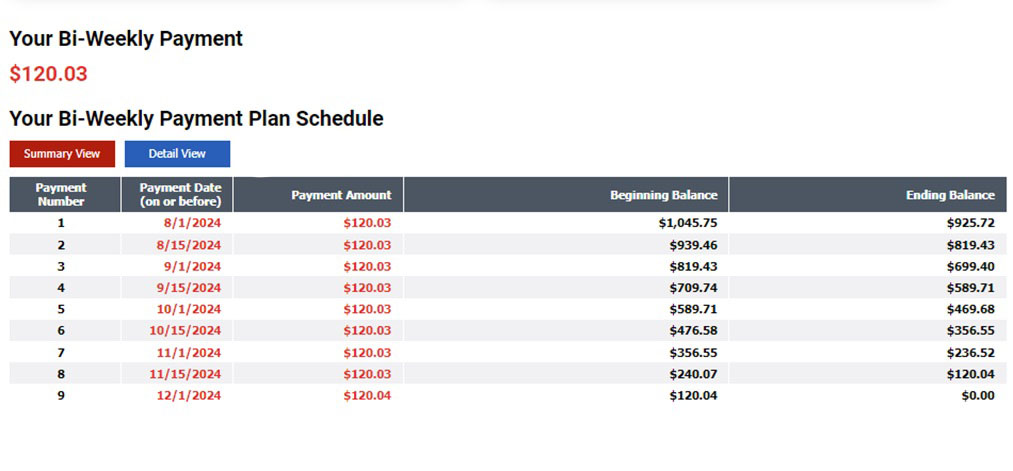

The calculator assists taxpayers who want to budget their property tax expenses over payments made monthly or every two weeks.

“There is no need for homeowners to be at the mercy of the merciless Annual Tax Sale,” Pappas said. “This Payment Plan Calculator can help them keep control when they may think all is lost.”

While the Treasurer’s Office has previously accepted partial tax bill payments, the calculator is designed to provide an actual system for those at risk of having their past-due taxes sold at the county’s Annual Tax Sale, an auction of unpaid property taxes.

“We want to do everything possible to help people pay off their tax debt,” Pappas said. “We routinely find that thousands of properties offered at our Annual Tax Sale are owned by people who owe less than $1,000 in taxes.”

Many homeowners were shocked by property tax increases this year, particularly in the south and southwest suburbs. They worry what will happen if they are unable to pay their bills in full by the Thursday, Aug. 1 due date.

Taxpayers may sign up to receive email or text message notifications reminding them to make the monthly or biweekly payments recommended by the Payment Plan Calculator.

Taxpayers may sign up to receive email or text message notifications reminding them to make the monthly or biweekly payments recommended by the Payment Plan Calculator.

State law requires that property owners who do not pay their taxes in full by the due date face additional interest charges of 0.75% per month, effective with 2023 taxes due in 2024. Late taxes that were due in 2023 and earlier years are charged interest of 1.5% per month.

The Annual Tax Sale occurs approximately 13 months after the Second Installment due date. Once unpaid taxes are offered at the Annual Tax Sale, the property owner must pay the overdue taxes and interest in one lump-sum payment.

“The Annual Tax Sale knows no mercy,” Pappas said. “We have to make it do so by enabling people to pay as they can in time to avoid it.”

Pappas said the Payment Plan Calculator grew out of deliberations by the Illinois Property Tax Payment Plan Task Force. The Illinois General Assembly in 2023 passed legislation that created the task force to recommend payment options designed to prevent tax-delinquent owner-occupied homes in Cook County from being sold at the Annual rate.

Also Read: Manuel Venegas new Press Secretary for Cook County Treasurer